Spread dan syarat terbaik kami

Ketahui selanjutnya

Ketahui selanjutnya

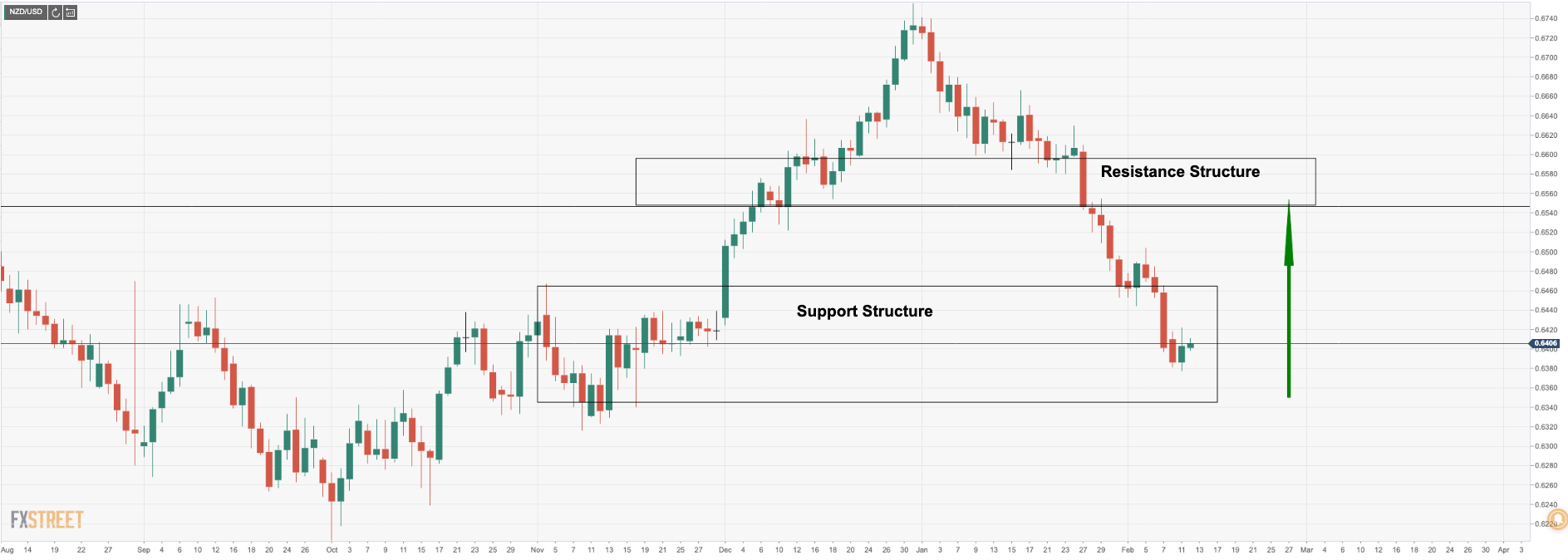

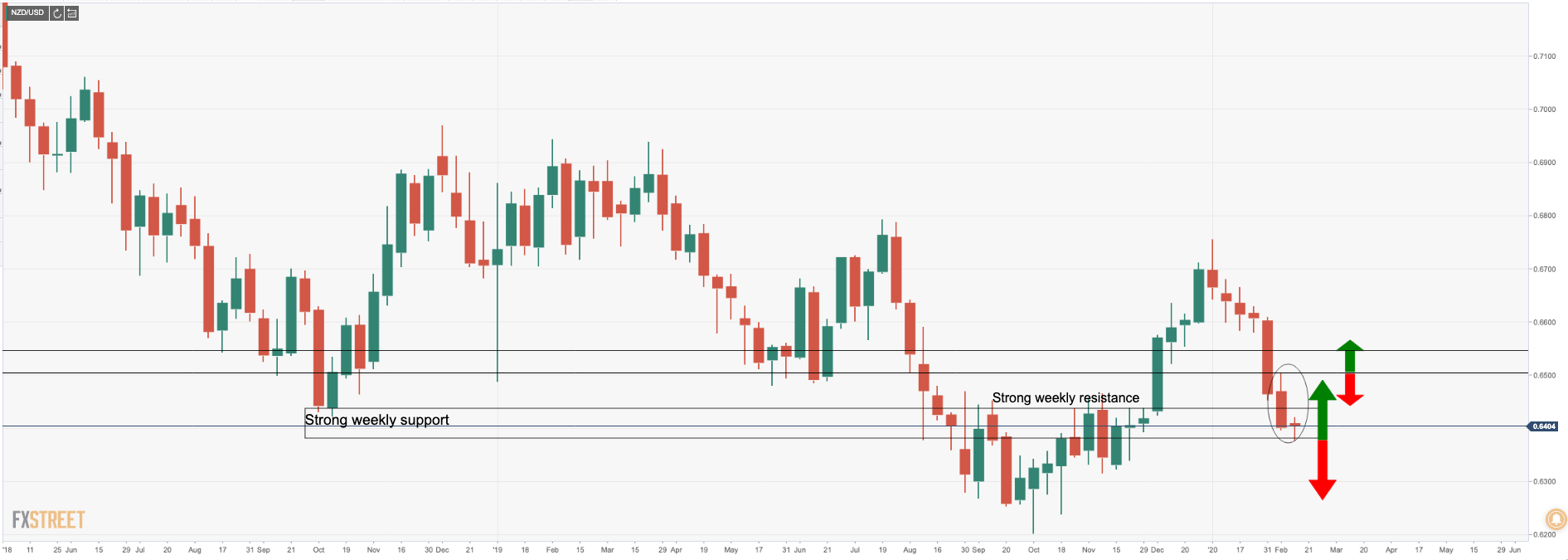

NZD/USD has been under pressure since topping out on the last trading day of 2019 up at 0.6755 in what appears to be a recovery and bottom of the 2018 downtrend. The price has completed a 61.8% retracement of the October 1st uptrend and meets the Sep-Dec resistance structure (Oct 2018 weekly support as well) which could well act as a major support structure.

The price is basing in a familiar support/resistance zone and while the markets do not move in a straight line, we can expect a series of waves through pivot point structures in a fresh attempt to the upside, so long as support holds.

As we can see, the support structure is looking rather robust, certainly worth looking for bullish entries on a correction before a possible fresh downtrend. Watch for a weekly close back above 0.6505, with a fade on rallies below back to 0.6380/00. A break below opens the 0.6230s.

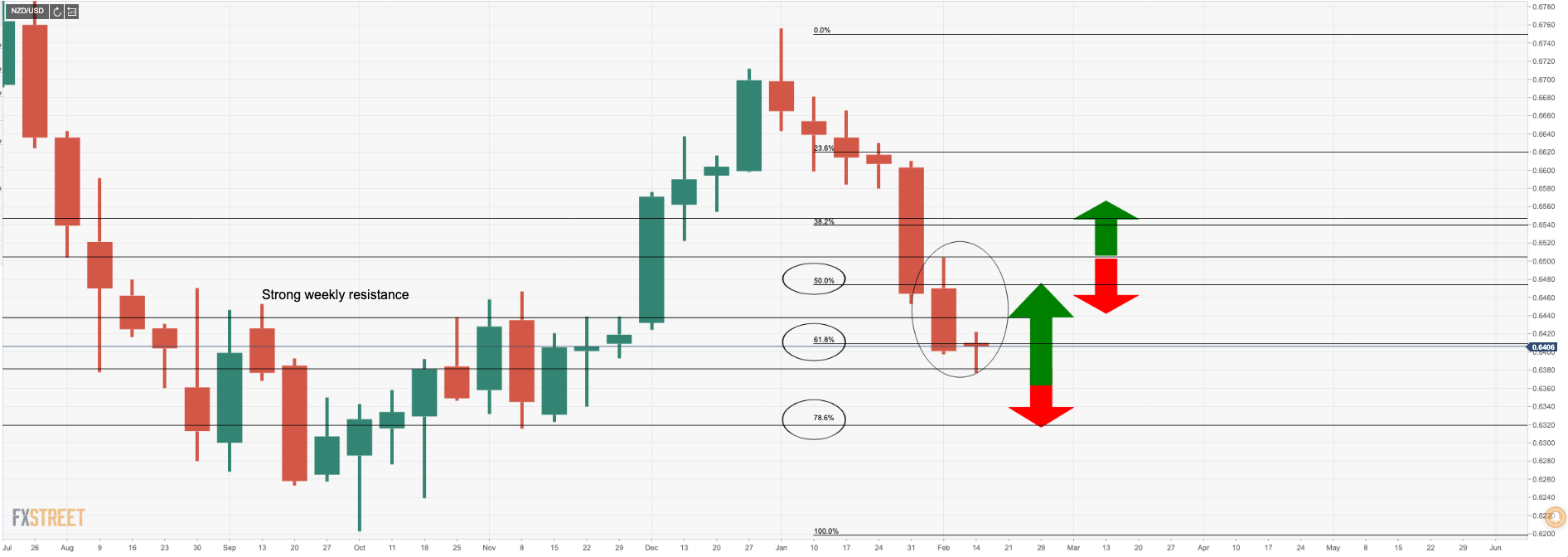

The Fibos are aligned with confluences and mark key areas of interest in the market. 0.6480/00 on the upside, 0.6400 support and 0.6320 on the downside are marked areas on the Fibo-scale. Note, the 61.8% is regarded as the golden ratio and has already been achieved, so there is a corrective upside bias at this juncture for which only entries on lower time frames would be recommended. Bears will look to short on failures between 0.6470/20s, in respecting the longer-term and broader bear trend.

Expectations are for no change in the OCR, but the skittish behaviour of the NZD reflects nervousness that the RBNZ might cut on the back of the hit to global growth stemming from the virus, which is starting to overshadow otherwise promising signs of improvement in domestic economic momentum," analysts at ANZ Bank argued, who recently downgraded their outlook for Gross Domestic Growth in 2020 for New Zealand, lowering projections to 0.8% for the first half of 2020 from 1.3%.

For a full preview of the RBNZ, see here: RBNZ Preview: Coronavirus should limit upside potential for NZD/USD